Positive economic growth, falling unemployment rates and renewed consumer confidence are luring investors back to Southern Europe property market. According to Alice Marwick, Savills European Research

It is good news to know that most of the Southern European nations are experiencing tremendous growth rates after wallowing in years of the high unemployment rate and low transaction volumes. The unemployment rate in these countries rose to the highest level valued at 21% in 2013, the rate has been decreasing recently, and Spain has been experiencing a significant rise and has recovered from the economic turmoil as a result of the execution of structural reforms carried out by the Federal Government in 2012.

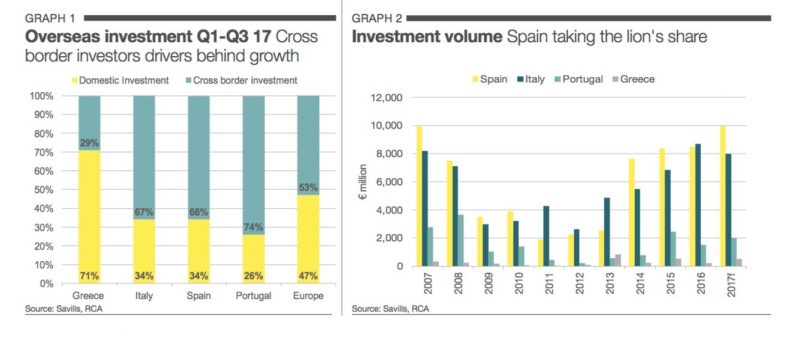

More investors are coming back with their investments to the nations once called the “PIGS OF EUROPE” because of the presence of possible rental growth and mouthwatering profits. It is crucial to note that the investment volume across Southern Europe has improved at a massive rate of 277% in 2017 because of the migration of investors to Spain, a higher figure, when compared with the investment volume, recorded five years ago in the region of €5.2bn. According to available data, the entire trade volume in Spain is about to exceed the long-term average investment volume and in 2018 align with the historical past peak recorded in 2007 valued at €9.9bn. In 2016, Italy won the investment feat as its entire year investment volume exceeded the long-term average by 54%.

SPAIN, THE NEW ECONOMIC HUB FOR INVESTORS

During the global economic recession, Spain was tagged to be a highly volatile market for investors, but the tide has changed as the same nation has evolved into a popular investment destination for investors. In Spain, there is a limitation to the ownership of distressed assets, and this has made unscrupulous investors to buy assets in countries like Greece and Portugal.

Without mincing words, the investment volume in Southern Europe valued at €13.2bn in H1 2017; an 8% increase than the preceding year as a result of increased investment in Spain. Presently, Spain has taken over from Italy as the most liquid Southern European market and likely to retain the crown in the next one year. However, Italy’s chances of matching the €8.7bn investment in 2016 are bleak as the 2017 H1 Spanish investment volume has exceeded the H1 2016 entire investment volume by 72% and with about €700m worth of assets presently under offer, the likelihood of beating the 2016 investment volume is sure.

Recently, the declaration made by Catalonia’s regional parliament has significantly improved the 10-year Government bond returns rising to a year high, and the Euro is falling against the United States Dollar. As the news of the Catalan independence has been gathering momentum, the report may discourage potential investors from placing their investment in the region, but there is a less probability that the news will have an adverse impact on the other areas of the country.

CROSS-BORDER INVESTORS DRIVING INVESTMENT VOLUMES

It is crucial to note that cross-border investors have been the major players in the investment stage with their involvement through REITs in Spain (Socimis) or direct investment. The funds from the United States are offering preferential treatment to Spain rather than Italy as Italy has shown slow reception to the Socimis. Cross-border investors have been playing a significant role and dominating the market in comparison to domestic buyers as their investment account for 70% of the H1 investment volume in contrast to the European Union average where cross-border investors are responsible for the 52% share except for Greece.

The United States and the European Union Funds are the leading cross-border players with an investment portfolio valued at 27% and 49% respectively abroad. The impact of the Asian investors is yet to be visible in Southern Europe, but the presence of viable economic stability across the countries in Southern Europe is likely to change that in the future. Since 2012, retail has enticed the attention of the foreign investors, and in the last six years, more than €3bn has been invested into retail while €1.6bn has been spent in offices. This year has seen the investment in office surpassed the retail investment as €372m was pumped into offices investment while €352m was invested in retail.

Local real estate investment firms still maintained their firm grip on Greece. The international investors will be on alert for investment opportunities in the hospitality sector as there is a sign of improvement in the economic fundamentals.

SOUTHERN EUROPEAN YIELDS VASTLY DIFFERENT

In Spain, prime office and retail yields are at their lowest points as prime office recorded 3.25% while retail returns recorded 4.25%. Moreover, in Italy, both of them have moved below their previous peak. However, they are more attractive and expected to go down further before the end of the year, and the chances of its stabilization are assured. The average Southern European prime office yield is expected to move in by 19bps yearly at the rate of 4.5% by the end of the year. Some business investors are encouraged by the fantastic priced opportunities in major cities such as Milan, Barcelona, and Madrid.

Institutional investors have been the players behind the increase in the investment volumes and leading yield compression in the last few years in Italy. After the office market hit the nadir, prime office values are on an early turnaround in Lisbon and Athens. Investors who are after fast profits are concentrating their attention on countries like Greece and Portugal as the returns in CBD are appealing and there is enough room for compression in comparison to the major cities in Italy and Spain.

LACK OF A UNIQUE QUALITY STOCK

As the unemployment rate reduces significantly, there is an increased demand for quality stock, but the absence of a good quality office stock across Southern Europe is worrisome. Investors in this category are reluctant to migrate into secondary or tertiary locations; tenants are requesting that there should be excellent office space in major areas which has led to a modest pricing plan. Opportunities are emerging for investors for redevelopment and renovation of the current stock in the CBD for immense profits. Since the introduction of the GFC, development activities have been restrained, and new supply is increasing steadily through renovations in the CBD, and the creation of new office hubs in good fundamentals support investor demand.

The absence of unique quality space in the CBD has been mounting pressure on rents, and the surge in demand has brought about a reduction in office vacancy rates in Lisbon, Madrid, and Milan. The non-CBD rents are also increasing but at a slower pace than the CBD as they profit from the tight supply in the center. In the last two years, Madrid and Barcelona have enjoyed the most robust European rental growth in Europe while the figures recorded by Milan and Lisbon are around the European average. Retail rents are increasing at a modest velocity; tenants have started the consolidation of their stores into a single, sizeable flagship store for their brand promotion. The high street retail sector is one of the major beneficiaries of the increase in consumer spending and tourism, especially in Rome, Barcelona, and other secondary cities with robust tourist connections. These areas are already under the observation of prospective investors as the retail investment in Italy has risen by 70% in the previous year.

BOOMING TOURISM SECTOR

The tourism sector has consistently experienced growth and been confirmed as a healthy and thriving industry. Barcelona, Rome, Madrid, and Milan are among the top cities when the list of the premium ten European destinations per overnight international guests is compiled. The Travel and Tourism sector contributed 18.6% of the Gross Domestic Product in Greece and believed to increase to 23.8% by 2027, and the number of tourists is expected to grow at the rate of 4.8% on an annual basis.

The number of tourists from China has increased significantly in Lisbon because of the Golden Visa scheme that encourages the influx of the Asian citizens as a 19% increase was recorded in 2016. However, Lisbon is one of the fastest growing European vacationer destinations when the annual growth is considered as the growth rate is valued at 7.4% in 2016. These fantastic and positive inclinations have encouraged the investors to focus their attention on high street retail and hotels in these cities. Investment in hotel business across Southern Europe has reached €2.9bn in the previous year, a surge from the figures realized in 2015 which is valued at €986m.

The Airbnb has been growing at a swift pace in Southern Europe, and local governments will be pressurized to regulate the number of Airbnb lettings to replicate the Barcelona prototype which is aimed at helping hotels to get more overnight customers from Airbnb.

TECH SECTOR AND ALTERNATIVE WAYS OF WORKING

Entire Southern Europe did not embrace the opportunity in the online shopping flourishing era; there is a probability that the Millennial and the Generation X will welcome the Tech Boom as the rate of unemployment is reducing steadily. An expansion in ecommerce will enhance the demand for logistics and warehouse space which has been straggling in Southern Europe.

The Tech subdivision has been experiencing a steady growth rate across Southern Europe, and the demand for serviced offices has also improved significantly. According to data available from Eurostat, Madrid, Lisbon, Barcelona, and Milan will experience Tech GVA growth rate of 3.2%, 2.2%, 2.1%, and 1.9% correspondingly in the coming four years. The unavailability of a good quality office stock has resulted in improved ways of working and increased demand for amenable offices and co-working spaces. The high unemployment rate has brought about the increase in the need for office space and the rise in entrepreneurialism and start-ups.

As the prospects for additional yield compression in prime offices and retail are increasingly limited, we have a firm belief that investors will shift their attention to other profitable assets that provide amazing profits. In Spain, we have witnessed a tremendous investor interest in the income-producing residential segment, especially the student housing units in the cities like Barcelona and Madrid.