Foreign investment in Australia’s residential property market has plummeted by almost two-thirds as tighter regulations start both here and abroad start to bite. The Foreign Investment Review Board (FIRB) annual report found both the number and value of residential applications dropped significantly through 2016.

On FIRB figures, the value of residential property approvals in 2016-17 was $25 million, down from $72 million the year before.

The number of residential approvals over the same period fell 67 per cent to 13,198 last year.

“The reduction in approvals reflects investor reaction to the introduction of FIRB application fees in 2015, which has changed investor behaviour by encouraging applications only for properties they intend to acquire,” the FIRB report said.

“Investors now have an incentive to apply only when they have a high certainty of purchasing.”

The FIRB report also pointed to a more intensive compliance regime being put in place with the Australian Taxation Office reporting residential real estate breaches had more than doubled from 260 (in 2015-16) to 549 last year.

Chinese investors dominate

Chinese investors are still the most active off-shore players across the real estate market, outlaying $1 in every $4 spent by foreign interests in residential and commercial property.

China’s property investments while down around 50 per cent over the year, still topped $15 billion in 2016-17, followed by Canada with $7.2 billion and the US with $6.8 billion.

“These half years [second half of 2016 and first half of 2017] were like night and day in terms of Chinese investment,” said Carrie Law, director of Chinese real estate website Juwai.

“In the second half of 2016, Chinese investment were investing in Australian real estate at an almost irrational pace … it was like money falling from heaven for vendors and developers,” she said.

“In early 2017, capital controls, financing restrictions, and foreign buyer taxes reduced Chinese investment to more reasonable levels.”

Ms Law said Chinese investment in property now appeared to be running at more sustainable levels.

“Chinese buying enquiries for Australian property in March were 5.7 per cent higher than the month before and in April they were 22.3 per cent higher.”

Applications down, direct investment up

Foreign investment applications across the board were softer over the year with the number of investment applications down 65 per cent 14,357, while the value of applications fell 22 per cent from $248 billion to $192 billion.

FIRB rejected three applications during the 2016-17 financial year, including the $10 billion sale of the big power distributor Ausgrid to Chinese interests.

However, foreign direct investment (FDI) — defined as foreign ownership of 10 per cent or more of a business — continues to rise.

FDI has risen every year since 2009, hitting $796 billion in 2016, an 8.5 per cent increase on the year before.

“FDI, which usually takes the form of equity or reinvested earnings, has averaged around 25 per cent of total foreign investment over recent years,” FIRB said.

Foreign ownership of farm land falls

FIRB also noted lowering the threshold of screening provisions for buying agricultural land from $252 million to $15 million meant there was a sharp increase for agricultural land applications it assessed.

Approvals were granted for about $7 billion worth of investments in agriculture, forestry and fishing last year, with China again being the biggest investors ($2.2 billion) followed by Canada ($1.5 billion) and the US ($0.9 billion).

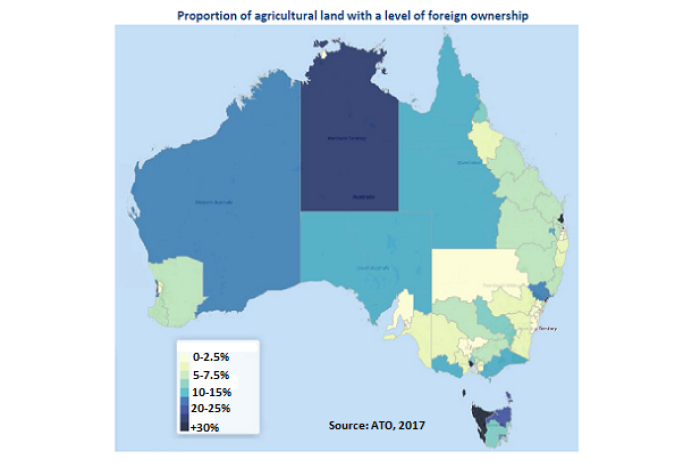

However, there was a slight decrease in the percentage of agricultural land owned by foreign interests from 14.1 per cent in 2016 to 13.6 per cent at June 30, 2017.

The United Kingdom remains the largest foreign agricultural land holder (2.6 per cent), followed by China (2.5 per cent) and the US (0.7 per cent).

Article by Stephen Letts abc